What causes Stock Price changes ?

Stock market tutorial - Understanding price changes

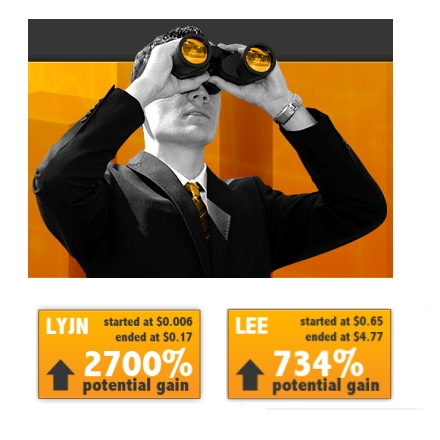

The market forces of supply and demand, like in any other market, directly affect the prices of various stocks. In other words, if the demand is high and there is less supply of a stock, the price of the stock

rise. On the other hand, if there is more supply compared with the demand of a stock, the price drops.

How supply and demand affect the prices is something most of us understand. However, the tricky part is understanding the factors which affect the demand and supply of the stocks. The news (good or bad)

affects the demand. In real time different people have different ideas and strategies to predict the demand and supply.

The change in price of a stock is a direct reflection of how investors feel about a company’s growth and net worth. Which means, the stock price does not necessarily reflect the real value of a

company. The value of a company is judged by its market capitalization which is determined by multiplying stock price with the number of issued shares(aka outstanding shares) excluding the repurchased

shares. For instance, a company trading at $25 per share with 1000 issued shares has less value than a company trading at $20 per share with 10,000 issued shares. The stock price also reflect investors

expectations with the growth of a company in future.

Earnings of a company is the most important factor for determining its value. The profit made by a company is its earnings and no business survives without making profit. Public companies are legally

required to report their profits four times per year i.e. once at the end of each quarter. Wall street pays close attention to companies reports released in these times which are also known as the earnings

seasons. It is the earnings reports on which analysts base the projections of the future value of a company. This means if a company’s reports are better than expected, the price jumps and if they do

not perform as per the expectations, the price drops.

There are many other factors which affect the price change of a stock. As it was seen in 90’s dotcom bubble when the prices of internet companies were going up without making smallest profits,

the market expectations were too high and the value of many of the internet companies shrunk to a fraction of the highest value. Investors have developed hundreds of formulas to predict the behaviour of

market forces, the price changes. price/earnings ratio, chaikin oscillator or moving average convergence divergence are an example of such indicators.

It must be clear to you that the price of stocks cannot be predicted with 100% accuracy since there are many unpredictable factors involved. This is the very reason why stock markets are considered

highly volatile.

However, the basic points which the investor must grasp are:

1. Fundamentally, supply and demand directly affect the stock price.

2. Value of a company = price of stock x number of issued shares. Price alone doesn’t determine the value of a company.

3. In theory, earnings determine the value of the company. However, in reality, there are many unpredictable factors which influence the price of stock. Thus, it boils down to the investors sentiments,

attitudes and expectations which influence the price changes.

4. Theories exists to explain why the prices moved/will move in a particular direction. However, no theory predicts the price changes with 100% accuracy.

Table of contents: Stock Market tutorial

1. Stocks: An introduction.

2. What are stocks ?

3. Types of stocks.

4. How stocks trade

5. How stock prices change ?

6. How to purchase stocks ?

7. How to read a stock table/quote.

8. Animals in stock market

9. Stock Market Tutorial: Summary.